Draft Charging Schedule and Draft Regulation 123 List

What is the Community Infrastructure Levy (CIL)?

1. The Community Infrastructure Levy (CIL) is a new charge which local authorities in England and Wales are empowered to charge on most types of new development in their area. CIL was introduced by thePlanning Act 2008 and defined in the CIL Regulations April 2010 (as amended). It is the Government's preferred mechanism for securing developer contributions towards local and strategic infrastructure improvements. Once a 'charging schedule' has been adopted, all new planning applications that first permit development are liable to pay CIL (i.e. outline or full planning applications).

(2) 2. CIL allows local authorities (known as "charging authorities") to raise funds from developers undertaking new developments in their area. The money can be used to fund a wide range of additional infrastructure that is needed to support sustainable development. The Planning Act 2008 provides a wide definition of infrastructure that can be funded through the CIL levy. This includes:

- roads and other transport facilities

- flood defences

- schools and other educational facilities

- medical facilities

- sporting and recreational facilities

- open spaces

The benefits of CIL

(2) 3. CIL is considered to be fairer, faster and more certain and transparent than the current system of planning obligations [1] which are generally negotiated on a 'case-by case' basis. The key benefits that CIL would bring are:

- CIL receipts will contribute towards meeting the shortfall in funding for planned infrastructure to meet the level of growth identified in the Council's Local Plan Core Strategy.

- CIL is non-negotiable and would give developers a greater degree of certainty, including when acquiring land interests, which in turn encourages greater confidence and inward investment.

- CIL provides a greater transparency, as collecting authorities will have to publish reports detailing how CIL receipts have been allocated.

- CIL gives the Council greater flexibility over what infrastructure funding may be spent on.

- CIL will be spent on infrastructure projects to enable development to come forward in a sustainable manner.

- A percentage of CIL receipts will be given over to Parish / Town Councils where development is happening to specifically assist in supporting local community infrastructure.

(1) 4. While CIL is not compulsory, the Council considers it important to progress a CIL expeditiously, as legislative changes will make it more difficult for the Council to secure developer contributions to fund essential infrastructure and mitigate the impact of development through section 106 Agreements. From April 2015, no more than five section 106 obligations can be pooled towards one project or type of infrastructure. Hence, CIL receipts are necessary to contribute towards the provision of infrastructure to support the level of development set out in the Local Plan Core Strategy.

Justification for introducing CIL

(2) 5. The Council has identified an infrastructure funding gap of approximately £49 million. It is anticipated that CIL receipts for the remainder of the plan period will be approximately £32.4 million (a proportion of which will be allocated to Town and Parish Councils). Please refer to the Funding Gap Analysis (January 2014) for further details.

(1) 6. Following the Preliminary Draft Charging Schedule (PDCS) consultation, the Council asked Peter Brett Associates (PBA) to undertake further viability testing to provide clarification on key areas in response to representations, changes to national guidance regarding affordable housing and section 106 threshold guidance; further analysis of extra care and residential homes viability, impact of lifetime homes on viability and clarifications and further guidance in respect of retail assumptions and scenarios.

7. CIL regulations require the Council to strike "an appropriate balance" between the desirability of funding infrastructure and the potential effect of the levy on economic viability of development across the district. While the viability work undertaken by PBA is considered to be robust and the recommended CIL rates are within their viability 'headroom', it is considered that a conservative approach to housing delivery in the district would be prudent by introducing a modest reduction in the consultant's recommended residential CIL rate. This should help in ensuring that building rates in the district are not adversely impacted upon by having a high levy.

(1) 8. Once the levy has been embedded locally there will be an opportunity to review CIL rates taking into account local market signals. It is envisaged that this will take place within three years of its introduction.

CIL Charging Rates

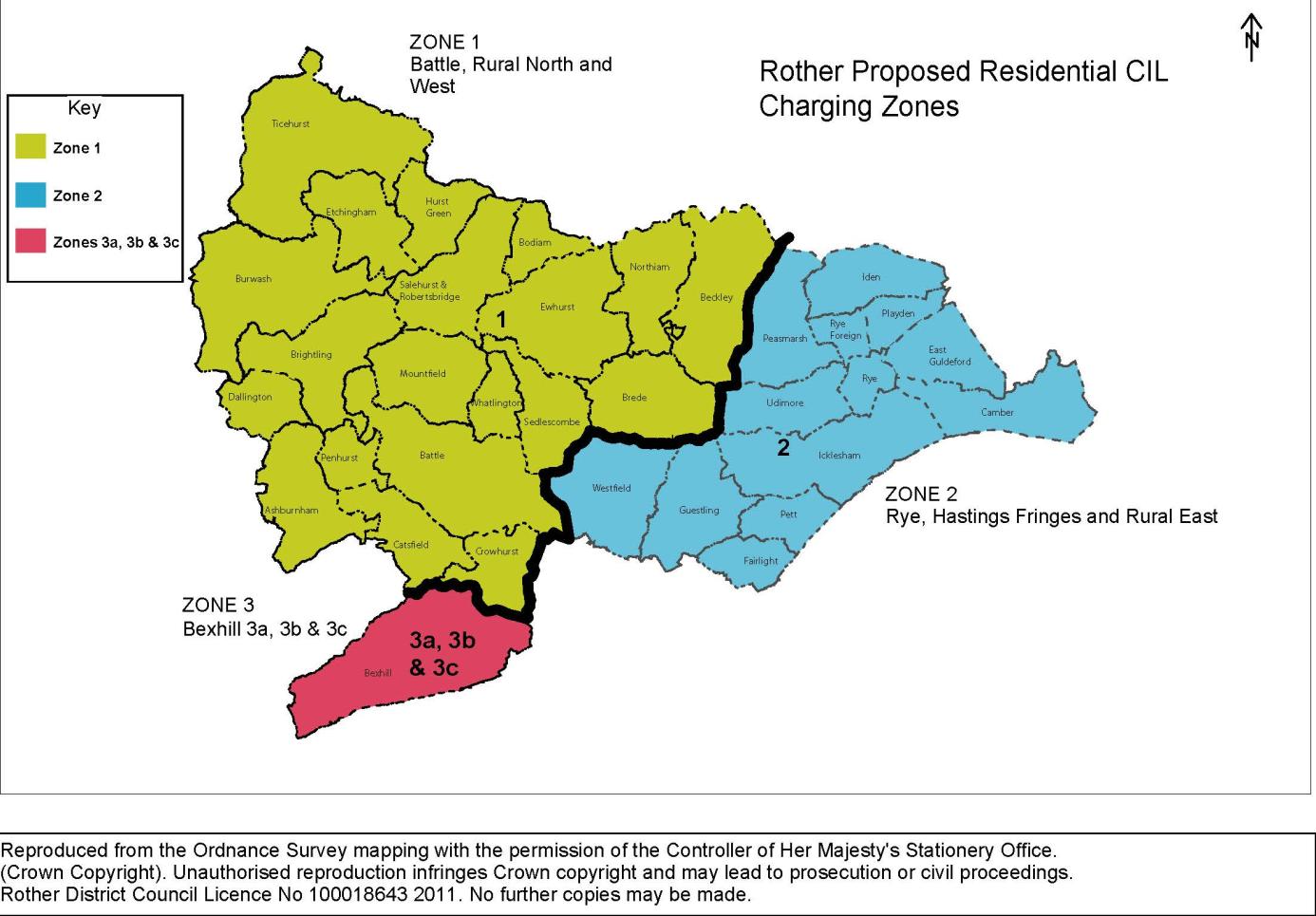

(13) 9. The proposed CIL rate in each CIL zone, as approved by the Council for the purposes of consultation, is shown in Table 1.

(2) Table 1: Proposed Residential CIL Charging Zones and Rates

|

Residential Zones |

CIL Rate |

|

Zone 1 |

|

|

Battle, Rural North and West |

£200 |

|

Zone 2 |

|

|

Rye, Hastings Fringes and Rural East |

£135 |

|

Zone 3 |

|

|

a) Bexhill - Urban |

£50 |

|

b) Bexhill - Greenfield/Fringes |

£170 |

|

c) Bexhill - Strategic Urban Extensions |

£100 |

|

Extra Care Housing - Greenfield |

£45 |

|

Extra Care Housing - Brownfield |

£25 |

|

Retirement Housing - Greenfield |

(as dwellings in zone) |

|

Retirement Housing - Brownfield |

(as dwellings in zone) |

|

Non-Residential Development |

|

|

Retail - in centre convenience |

£100 per sq.m |

|

Retail - out of centre convenience |

£120 per sq.m |

|

Retail - out of centre comparison |

£250 per sq.m |

|

All other forms of Development |

£0 per sq.m |

(3) 10. In setting its CIL rates in accordance with the Community Infrastructure Levy Regulations, Rother District Council has struck an appropriate balance between:

- the desirability of funding from CIL (in whole or part) the estimated total cost of infrastructure required to support the development in Rother District Council, taking into account other actual and expected sources of funding; and

- the potential effects (taken as a whole) of the imposition of CIL on the economic viability of development across the district.

CIL Charging Zones

Within Bexhill, the zones are defined as:

3a - non-greenfield sites within the extant 'development boundary' for the town

3b - all other sites in and around the fringe of the town, except as covered by 3c below

3c - developments within (or mainly within) either the allocated sites BX2 and BX3 in the Local Plan 2006 or within the broad location for future growth to the north of the town, as identified in the SHLAA 2013

When is CIL Payable?

11. When planning permission is granted to CIL liable development, a liability notice will be sent which will contain the amount of CIL that is due for the development, including when the total amount must be paid. The Regulations state that CIL liability is payable in full at the end of the period of 60 days, beginning with the intended commencement date of development, unless the charging authority has adopted an Instalment Policy.

Instalment Policy

(5) 12. Following the PDCS consultation there was strong support for the implementation of an Instalment Policy which will contribute to making many development schemes viable by having phased payment of CIL liabilities rather than one large cash sum upon commencement of development. Therefore, the Council will develop its Instalment Policy as part of the overall governance protocol to implement CIL. It should be noted that an Instalment Policy will not be subject to the examination process.

13. The CIL Regulations 2010 (as amended) enable a charging authority to introduce an Instalment Policy for the payment of CIL. Failure to comply with the Instalment Policy at any stage will result in the total unpaid balance becoming payable immediately (Regulation 70(8) Community Infrastructure Levy (amendment) Regulations 2011). The Local Authority is free to decide the number of payments, the amount and time due, but, (under Regulation 68B) must publish an Instalment Policy on their website. This may be revised when appropriate.

14. It is expected that large development schemes will apply to be phased and, as such, CIL liability will be calculated for each phase rather than for the scheme as a whole. In these cases payment of CIL will be spread by phase of development and each phase will be able to benefit from the Instalment Policy.

Exemptions and Discretionary Relief from CIL

(4) 15. The Regulations allow mandatory relief for affordable housing and certain types of developments. Affordable housing will continue to be delivered through section 106 Agreements. Also excluded from CIL is self-build housing. The CIL Regulations exempt the following from paying the CIL:

- Development by registered charities for the delivery of their charitable purposes.

- Those parts of a development which are to be used as social housing.

- The conversion of any building previously used as a dwelling house to two or more dwellings.

- Development of less than 100 sq m of new build floorspace, provided that it does not result in the creation of a new dwelling.

- The conversion of, or works to, a building in lawful use that affects only the interior of the building.

- Development of buildings and structures into which people do not normally go (e.g. pylons, wind turbines, electricity sub stations).

16. The CIL Regulations allow for the Council to provide further relief, at their discretion. The Council do not have to offer this relief, but if they chose to do so, they must adopt a discretionary relief policy. This is not part of the charging schedule and may be published at a different time.

Draft Regulation 123 List

(5) 17. The Council is required to publish a list of those infrastructure projects that will be funded by CIL. This is called a 'Regulation 123 List'. It can be found in Appendix 2. Regulation 123 of the Community Infrastructure Regulations 2010 (as amended) restricts the use of planning obligations (s106 agreements) for infrastructure that will be funded in whole or in part by CIL. This is to ensure that individual developments are not charged for the same infrastructure items through both planning obligations and the levy.

18. A CIL charging authority is expected to prepare a draft Regulation 123 (Reg.123) list for the examination of the CIL Charging Schedule. The inclusion of a project or type of infrastructure in any published list does not signify a commitment from the Council to fund (either in whole or in part) the listed project or type of infrastructure through CIL. The order in the table does not imply any order of preference for spend.

19. Once adopted, the Reg.123 list can be amended at any time but this process must be compliant to the CIL Regulations in order for this to happen.

Provisions for Town and Parish Councils

(3) 20. In accordance with the CIL regulations, a certain percentage of receipts has to be passed onto the Town or Parish Council where the development is taking place. These amounts will be:

- 25% of relevant CIL monies if the development is taking place in an area that has a neighbourhood development plan in place; or

- 15% of relevant CIL monies in all other areas - up to a maximum cap of £100 per dwelling in that area, in that financial year (index linked).

21. It is expected Town and Parish Councils must spend their CIL monies to support the development of their area by funding:

- the provision, improvement, replacement, operation or maintenance of infrastructure; or

- anything else that is concerned with addressing the demands that development places on an area.

Next Steps

(1) 22. Following this consultation, the Council will submit the Draft Charging Schedule (DCS) to the Secretary of State for Examination along with any modifications if appropriate. The current timetable is for the DCS to be submitted for Examination in late spring 2015. Dependent upon the Examination date, it is envisaged that the DCS can go to full Council for adoption in the summer of 2015. The Council will then decide on an adoption date.

(1) 23. A priority for the Council will be the delivery and approval of goverance protocols for spending CIL monies and a mechanism to pass on CIL receipts to Town Councils and the Parishes. The Regulations permit up to 5% of CIL receipts to be used to implement and administer CIL. Costs in the preparation and implementation of the Rother CIL can therefore be recovered from future CIL receipts.

Appendix 1 - Calculating the Charge

The formal calculation methodology is provided in Regulation 40 and Part 5 of the CIL Regulations 2010, as amended.

- The collecting authority must calculate the amount of CIL payable ("chargeable amount") in respect of a chargeable development.

- The chargeable amount is an amount equal to the aggregate of the amounts of CIL chargeable at each of the relevant rates.

- But where that amount is less than £50 the chargeable amount is deemed to be zero.

- The relevant rates are the rates, taken from the relevant charging schedules, at which CIL is chargeable in respect of the chargeable development.

The amount of CIL chargeable at a given relevant rate (R) must be calculated by applying the following formula:

R x A x lp

---------------

Ic

- A = the deemed net area chargeable at rate R;

- Ip = the index figure for the year in which planning permission was granted; and

- Ic = the index figure for the year in which the charging schedule containing rate R took effect.

The index figure for a given year is:

- a) the figure for 1 November for the preceding year in the national All-in Tender Price Index published from time to time by the Building Cost Information Service of the Royal Institution of Chartered Surveyors; or

- b) if the All-in Tender Price Index ceases to be published, the figure for 1 November for the preceding year in the Retail Prices Index.

The value of A must be calculated by applying the following formula:

Net Chargeable Area (A) = GR - KR - {GR x E}

-------------

G

- G = the gross internal area of the chargeable development;

- GR = the gross internal area of the part of the chargeable development chargeable at rate R;

- KR = the aggregate of the gross internal areas of the following:

-

- retained parts of in-use buildings; and

- for other relevant buildings, retained parts where the intended use following completion of the chargeable development is a use that is able to be carried on lawfully and permanently without further planning permission in that part on the day before planning permission first permits the chargeable development.

- E = the aggregate of the following:

-

- the gross internal areas of parts of in-use buildings that are to be demolished before completion of the chargeable development;

- for the second and subsequent phases of a phased planning permission, the value Ex, unless Ex is negative; and

- provided that no part of any building may be taken into account under both of paragraphs (a) and (b) above.

The value Ex must be calculated by applying the following formula:

EP - (GP - KPR)

- EP = the value of E for the previously commenced phase of the planning permission;

- GP = the value of G for the previously commenced phase of the planning permission; and

- KPR = the total of the values of KR for the previously commenced phase of the planning permission.

(6) Appendix 2 - Draft Regulation 123 List

Regulation 123 of the Community Infrastructure Levy Regulations (as amended) requires charging authorities to set out a list of those projects or types of infrastructure that it intends to fund either wholly or partially through the CIL levy. This is to ensure that individual developments are not charged for the same infrastructure items through both planning obligations and the levy.

A CIL charging authority is expected to prepare a draft Regulation 123 list (Reg.123) for the examination of the CIL Charging Schedule.

The following types of infrastructure will be funded through CIL receipts by the charging authority. The order in the table below does not imply any order of preference for spend. Rother District Council retains the right to determine where CIL contributions are spent and projects and priorities will be set out though governance protocols.

|

Infrastructure Type or Project eligible to be funded wholly or partially by CIL |

Exclusion |

|

Transport Road: Improvements to road network capacity including the following schemes identified in the IDP: Improvements to A2036 Corridor Penland Rd n. bound / w. bound. Junction improvements at A269/ Watermill Lane. A259 Little Common roundabout Junction improvements including Peartree Lane approach and A259 e. bound. Town centre traffic management improvements B2098 Terminus Road / Buckhurst Place / Sackville Road. Junction improvements along A259 corridor including A259 / B2095 approach and A259 / Sutherland Avenue. New road from development access junction north to connect with Watermill Lane and A269 Ninfield Road known as the North Bexhill Access Road. Rail: Access improvements to stations which may include additional car parking, cycle and pedestrian access and facilities based on findings of ESCC Station Audit and plans of train operating companies. Bus, Cycling and Walking Infrastructure: Bus stop accessibility Bus shelters Passenger information and electronic ticketing Speed management measures Passenger and public security and safety Bus reliability measures Passenger access and information improvements to railway stations Cycle network improvements Public realm improvements Safety infrastructure outside schools Rights of way improvements Improvements to walking and cycling infrastructure to ensure connectivity and accessibility of new development into existing networks, communities, town and secondary centres, employment and social infrastructure in accordance with Rother's Cycling and Walking Strategy. Management of cross town traffic congestion in Battle. Improved traffic management. Implement measures to increase use of sustainable transport in accord with LTP3. Introduce measures to tackle heavy congestion in Rye town centre during the summer. Increase sustainable transport provision in the town in accord with LTP3. Public car park facilities. |

Site specific improvements needed to make the development acceptable in planning terms. These exclusions can include (but not limited to): Highways crossover to access the site and local junctions; Deceleration and turning lanes; Measures to facilitate pedestrian, public transport and cycling improvements and access; Lighting and Street furniture needed to mitigate impact of development; and Mitigation works remote from the development where the need for such works is identified in a Transport Assessment. A269 / Holliers Hill / A2036 Wrestwood Road / London Road |

|

Education Provision of additional Early Year places; Provision of additional Primary School capacity; Provision of additional Secondary School capacity; Provision of additional further education workplaces; and in accordance with the latest ESCC's Education Commissioning Plan. Workplace Training. |

Provision of a new Primary and Nursery School to be provided in accordance with adopted North East Bexhill SPD and Policy BX2 of the adopted Rother District Local Plan (July 2006). |

|

Leisure, Sport, Open Space, Environment and Green Infrastructure Provision of facilities for addressing open space deficiencies in terms of quantity, quality or accessibility, particularly those identified in Rother District Council's Open Space, Sport and Recreation Audit and Assessment. Provision of facilities to address deficiencies in indoor and built sports, recreation or leisure facilities in accordance with Policy CO3 in the adopted Rother Local Plan Core Strategy and in particular those identified in the Hastings - Rother Leisure Facilities Strategy ('09-'20). |

Provision necessary to make the development acceptable in planning terms. |

|

Community Facilities Provision of new facilities for community use and improvements to existing facilities as identified in Parish/Town Council's Local Action Plans, Infrastructure Delivery Plan and Neighbourhood Plans. |

Provision necessary to make the development acceptable in planning terms. |

|

Healthcare Provision of facilities to address existing or future needs. |

Provision necessary to make the development acceptable in planning terms. |

|

Emergency Services Provision of facilities to address future needs. |

Provision necessary to make the development acceptable in planning terms. |

|

Flood Mitigation New Flood Defence Construction as identified in the Infrastructure Delivery Plan. Maintaining and improving flood and coastal defences. |

All other site specific SUDS and on-site flood mitigation improvements as identified in a site specific assessment and to make the development acceptable in planning terms. |

[1] Planning obligations under section 106 of the Town and Country Planning Act 1990 (as amended).